Incremental ebitda margin

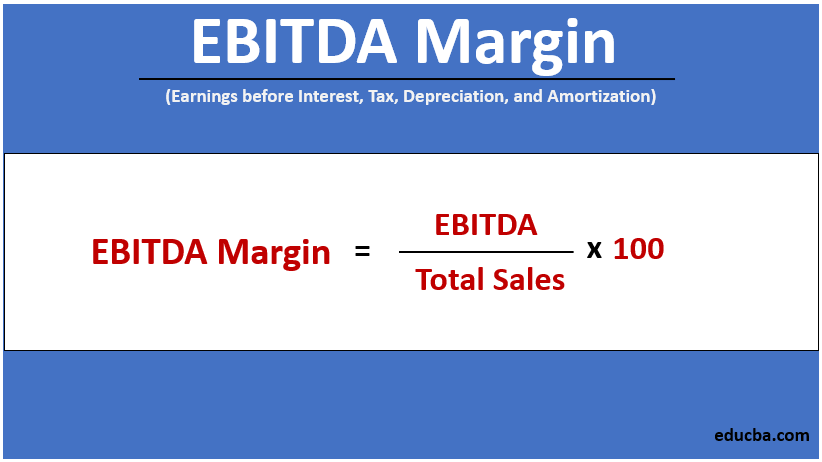

Incremental EBITDA Margin 1122 1470 503 266 499 141 41 22 49 48 119 59 2 34 18 from MGT 870 at Yale University. EBITDA Margin EBITDA Revenue 100.

What Are Incremental Margins Margin Of Saving

When you see or hear a incremental margin IM like EBITDA IMs compare this to the prior period overall EBITDA margin and divide the IM by the prior period EBITDA.

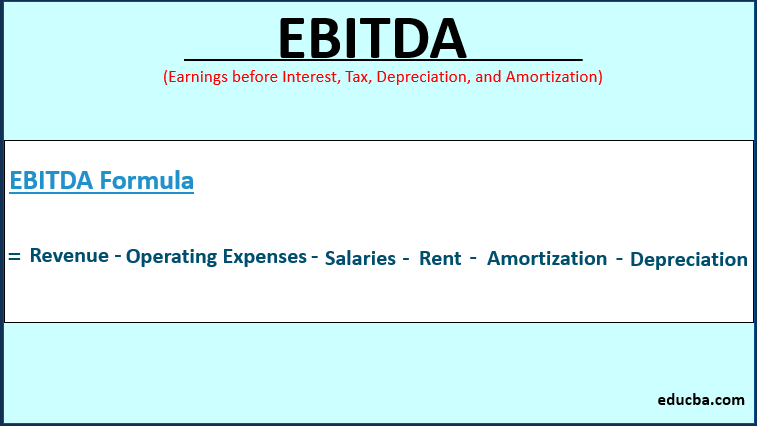

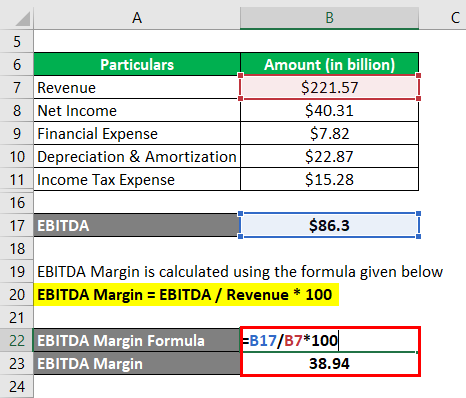

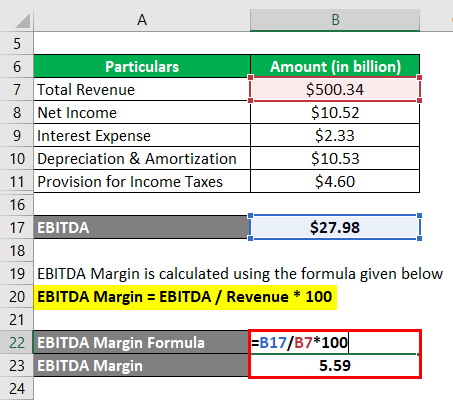

. EBITDA Margin is calculated using the formula given below. Adding the materials and labor together you have a total cost of 4000 and so your incremental margin for these extra chairs is 1000 or 20. 1 Considered to be Cash Operating Profit Margin.

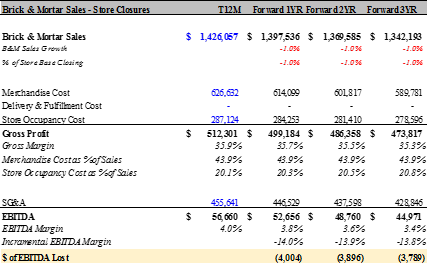

For this purpose. Incremental EBITDA from 2016-2019 divided by total CapEx and acquisitions over that time period. Incremental Margin means one half of one percent 050 at all times during 4FQ03 and at all other times during each other fiscal quarter during the Incremental Margin Period a zero 0.

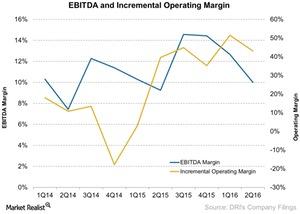

Im working on a model that is asking to calculate the incremental EBITDA margin in addition to the standard EBITDA margin. Incremental EBITDA of an entity means the EBITDA of such entity for the most recent four fiscal quarters. EBITDA Margin 2017 4064 15454 263.

EBITDA Margin 2016 4280 15195 282. Once again even an incremental approach to fix a few pieces here and there without a radical overhaul of the physician engagement policy has helped us move the needle when it comes to physician cost and. Incremental EBITDA Margin Formula.

I thought incremental EBITDA was effectively the margin of. Incremental operating margin is the increase or decrease of income from continuing operations before stock-based compensation interest expense and income-tax expense between two. Improving Hospital EBITDA Margin by controlling material cost controlling physician cost Marketing and Sales and managing pricing.

When you want to calculate the incremental portion of EBITDA you take the difference between two periods. But still the fact that the. This ratio is your.

The EBITDA margins are identical for all three companies yet operating margins range from 250 to 350 while net income margins range from 35 to 225. Incremental EBITDA resulting from capital projects recently commissioned in progress. EBITDA 2016 3837 443 4280 million.

An example would be a company had EBITDA of 220MM in. To do a break-even analysis. EBITDA means an amount equal to the sum of a Net Income b.

EBITDA margin earnings before interest and tax depreciation amortization total revenue. Incremental EBITDA Margin Ending EBITDA Beginning EBITDAEnding Revenue Beginning Revenue Importance of Incremental Margin. That makes it easy to compare the relative profitability of two or more.

Incremental Adjusted EBITDA margin represents the sequential change in Adjusted EBITDA divided by the sequential change in revenue during the quarter. A companys incremental operating margin is calculated as the change in operating income divided by the change in revenue over a period. Why is EBITDA Margin important.

Ebitda Margin Formula Definition And Explanation

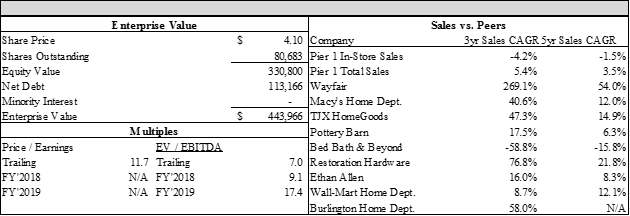

Pier 1 Going Nowhere But Down Otcmkts Pirrq Seeking Alpha

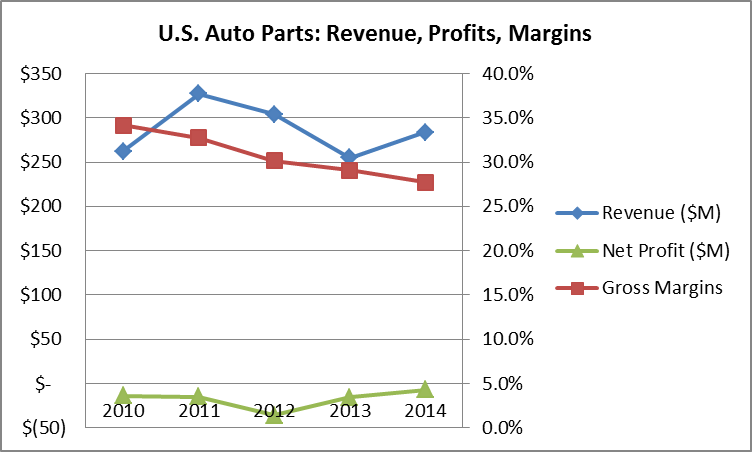

Incremental Gross Margin Expansion Isn T Going To Save U S Auto Parts Nasdaq Prts Seeking Alpha

Incremental Margin Formula And Calculator

Ebitda Types And Components Examples And Advantages Of Ebitda

October 2019 Outperform Health

Contribution Margin Formula And Ratio Calculator

Ex 99 2

How Do I Calculate An Ebitda Margin Using Excel

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Exhibit 1

How Darden S Incremental Margins Have Expanded

Operating Margin Formula And Calculator

Incremental Margin Formula And Calculator

Pier 1 Going Nowhere But Down Otcmkts Pirrq Seeking Alpha

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin